Financial key figures:

Data are as at December 31, 2024

9,570 GROSS DEBT EXCLUDING IFRS 16 (€M) | 7,319 NET DEBT EXCLUDING IFRS 16 (€M) |

13,217 GROSS DEBT INCLUDING IFRS 16 (€M) | 10,966 NET DEBT INCLUDING IFRS 16 (€M) |

A2 STABLE / MOODY'S LONG TERM RATING | A STABLE / S&P LONG TERM RATING |

EssilorLuxottica aims at maintaining continuous liquidity in order to ensure its independence and growth through significant and steady cash flows. The group also observes some liquidity principles aiming at securing funding availability at all times at the lowest possible costs. This principle relies upon the diversification of funding sources, the use of medium and long-term financings, the distribution of maturities over time, the recourse to credit facilities and the use of liquidity reserves.

Funding principles

- Liquidity management is centralized at the level of the group parent company.

- Source of funding diversification is the cornerstone of liquidity policy.

Rating

Maintaining a strong credit rating is the best way to provide an access to a wide range of funding sources. EssilorLuxottica credit ratings are based on the assessment of its credit profile and its ability to repay its debt by Moody’s and Standard & Poor’s. These ratings are purely indicative and may be modified at any time.

Long term | Short term | Outlook | Last confirmation | |

Moody's | A2 | Prime-1 | Positive | |

Standard & Poor's | A | A-1 | Stable |

Data are as at December 31, 2024

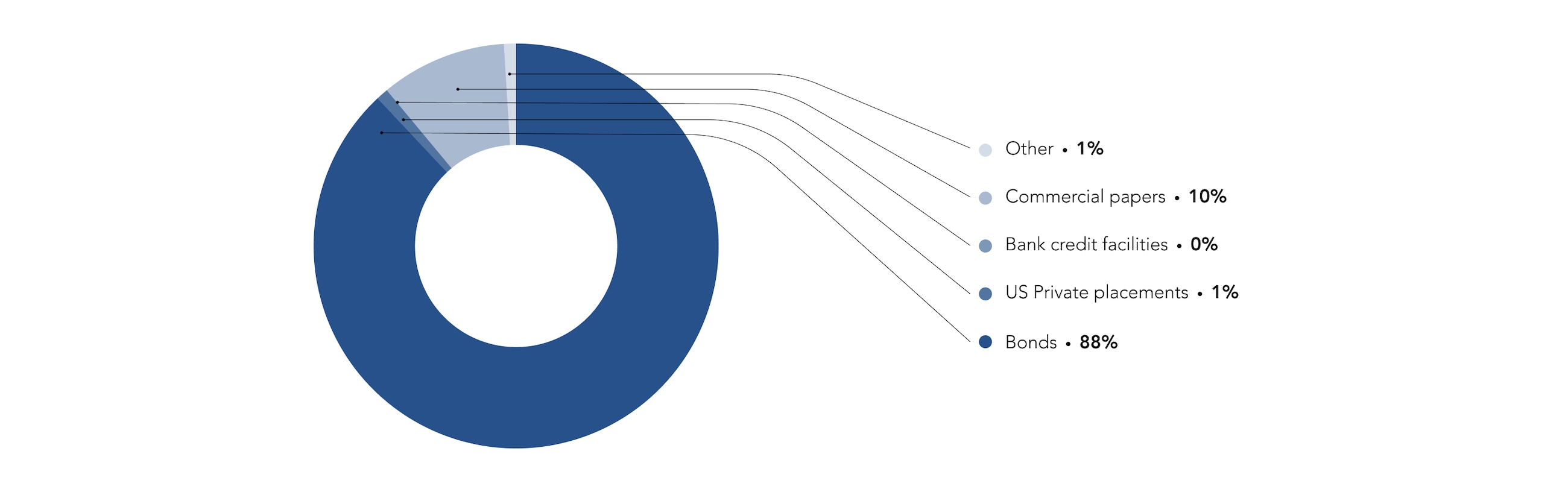

The group diversifies its financings across:

- instruments: bond, private placement, term loan, commercial paper, leasing;

- geographies: Europe, US, Asia, local markets;

- tenors: short-term, long-term;

- currencies;

- interest rates: floating, fixed, capped; and

- drawn/undrawn instruments.

Gross debt structure

Long term funding

Providing long-term funding helps securing the group’s ability to carry-out its strategy on a long-term horizon irrespective of potential market disruptions.

Short term funding

EssilorLuxottica entertains US commercial paper (USCP) and Negotiable EUropean commercial paper (NEU CP) programmes. They are a flexible and cost-effective tool to raise monies with very short notice, which is well-suited to working capital funding needs.

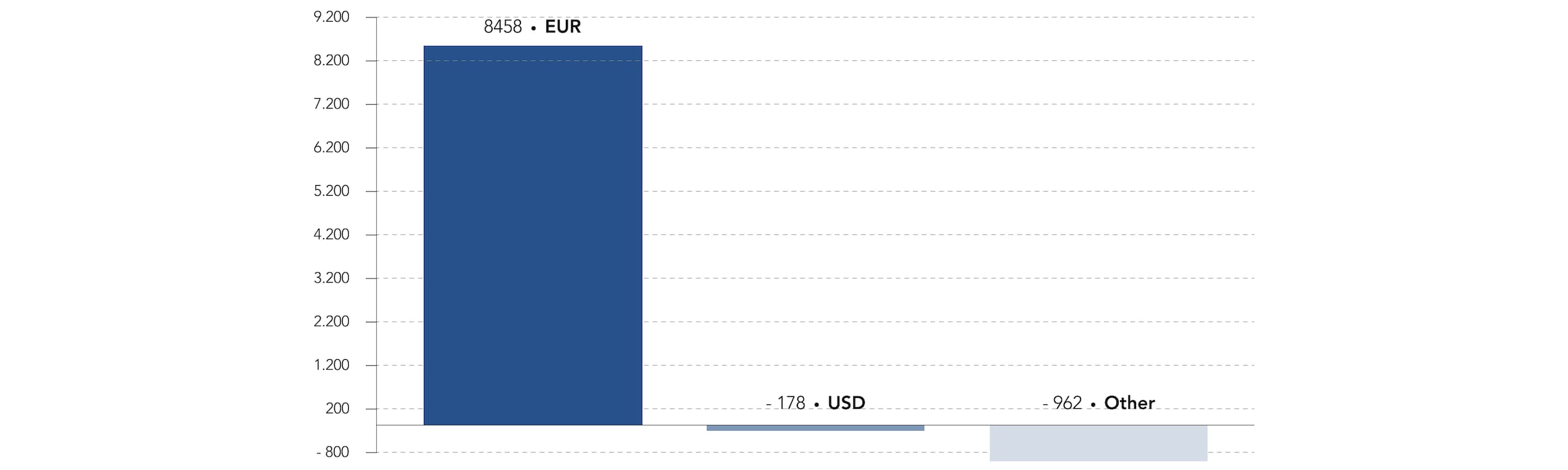

Net debt (currencies)

AFTER FX SWAPS, IN MILLIONS OF €

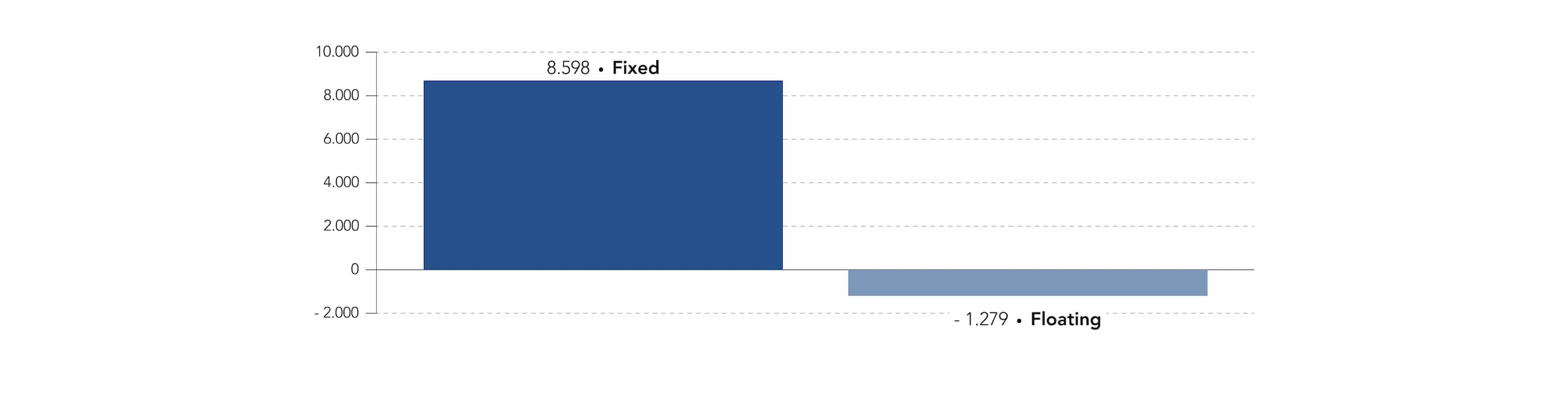

Net debt (interest rates)

AFTER IR SWAPS, IN MILLIONS OF €

Data are as at December 31, 2024

While the group mainly finances itself through financial markets, it also secures its permanent access to liquidity through long-term committed credit facilities (syndicated, bilateral lines and bridge facilities) concluded with a pool of close banks. Such credit facilities are a funding buffer and a back-up for the group’s short-term commercial paper programs.

As of December 31, 2024

- all bank committed credit facilities were undrawn. Their aggregate amount significantly exceeded the upcoming debt maturities due in 2025;

- available cash was €2,251 (€m).

As of December 31, 2024 the average maturity of the gross debt was 3 years.

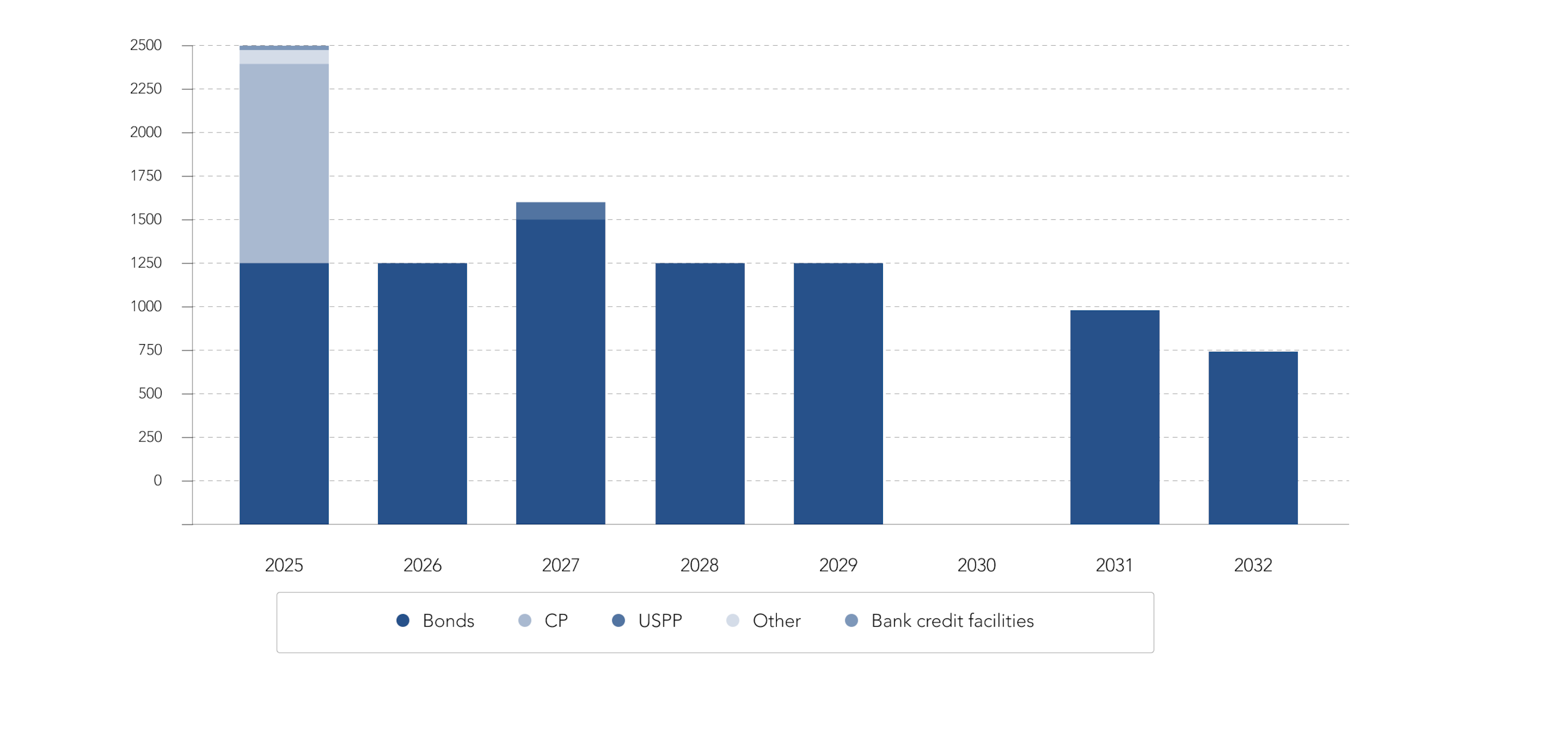

Debt Maturity Profile

IN MILLIONS OF €

1. Long term financing

EMTN: European Medium Term Notes

Issuer | Information |

EssilorLuxottica | Amount:€12bn Date of renewal: April 28, 2025 Maturity: Yearly renewal BASE PROSPECTUS DATED APRIL 28, 2025 (PDF) Archives: PROSPECTUS SUPPLEMENT DATED 29 JULY 2024 (PDF) BASE PROSPECTUS DATED APRIL 23, 2024 (PDF) BASE PROSPECTUS DATED APRIL 27, 2023 (PDF) BASE PROSPECTUS DATED MAY 6, 2022 (PDF) BASE PROSPECTUS DATED MAY 12, 2021 (PDF) BASE PROSPECTUS DATED MAY 26, 2020 (PDF) SECOND PROSPECTUS SUPPLEMENT DATED NOVEMBER 13, 2019 (PDF) PROSPECTUS SUPPLEMENT DATED NOVEMBER 6, 2019 (PDF) BASE PROSPECTUS DATED MAY 23, 2019 (PDF) BASE PROSPECTUS DATED DECEMBER 13, 2018 (PDF) BASE PROSPECTUS DATED APRIL 20, 2018 (PDF) PROSPECTUS SUPPLEMENT DATED JUNE 16, 2017 (PDF) BASE PROSPECTUS DATED MAY 9, 2017 (PDF) BASE PROSPECTUS DATED MARCH 24, 2016 (PDF) PROSPECTUS SUPPLEMENT DATED JULY 30, 2015 (PDF) BASE PROSPECTUS DATED DECEMBER 23, 2014 (PDF) PROSPECTUS SUPPLEMENT DATED APRIL 1, 2014 (PDF) |

Outstanding bonds

Issuer | ISIN code | Instrument | Issue date | Maturity date | Currency | Coupon | Coupon |

| EssilorLuxottica | FR0013463676 | Eurobond | November 27, 2019 | November 27, 2031 | € | 1 billion | 0.750 % |

| EssilorLuxottica | FR0013516077 | Eurobond | June 5, 2020 | June 5, 2028 | € | 1.25 billion | 0.5% |

| EssilorLuxottica | FR0013463668 | Eurobond | November 27, 2019 | November 27, 2027 | € | 1.5 billion | 0.375 % |

| EssilorLuxottica | FR0013516069 | Eurobond | June 5, 2020 | January 5, 2026 | € | 1.25 billion | 0.375 % |

| EssilorLuxottica | FR0013463650 | Eurobond | November 27, 2019 | May 27, 2025 | € | 1.5 billion | 0.125 % |

| EssilorLuxottica | FR001400RX89 | Eurobond | September 5, 2024 | March 5, 2029 | € | 1.25 billion | 2.875% |

| EssilorLuxottica | FR001400RYN6 | Eurobond | September 5, 2024 | March 5, 2032 | € | 750 million | 3% |

| EssilorLuxottica | FR001400RYN6 | Eurobond | September 5, 2024 | March 5, 2032 | € | 750 million | 3% |

| EssilorLuxottica | FR0014010BK0 | Eurobond | June 10, 2025 | January 10, 2030 | € | 1 billion | 2.625% |

US Private Placements

Issuer | Issue date | Outstanding Maturity dates | Currency | Issued amount | Outstanding amount as of December 31, 2024 |

EssilorLuxottica | 2017 | 2027 | $ | 300m | 100m |

Bank credit facilities

As of December 31, 2024 EssilorLuxottica’s committed bank credit facilities amount to €2.8 billion equivalent, including

(i) a €1,750 million euros five-year syndicated credit facility entered in 2021 reaching maturity in May 2028; and

(ii) several bilateral credit facilities;

All are undrawn.

2. Short term financing

Issuer | Program | Signing date | Maturity date | Currency | Programme |

| EssilorLuxottica | US Commercial Paper | October 1, 2018 | / | $ | 2bn |

| EssilorLuxottica | June 4, 2024 | Yearly renewal | € | 3bn |